2025 Money goal update!

What is done and in the books.

When was it accomplished?

- 2025/2026 School Year Fund – December 2024

- Partner’s new cell phone – January 2025

What are we working on.

How much is accomplished? Estimated end date?

- 529 – 26% – October 2025

- Taxes & fees for new phones – 44% – March 2025

- Summer 2026 care – 40% – May 2025

- This one requires some explaining as to how we got it so big so fast. The biggest is money we had earmarked for the 2025 summer that we didn’t spend. The consistent, money that is put in a savings account for our child stays in the account until it is used for the child. It is out of circulation for general household funds. That includes any interest earned within that account. High yield savings account yield higher interests payments.

- Emergency Fund – 71% – Only heaven knows.

- This one is back burner but slowly and consistently growing from the interest payments which stay within the emergency fund.

What’s on deck?

Is there an estimated end date?

- Big Anniversary Year – July 2025

- Children’s social group – September 2025

- Extracurricular athletic classes – October 2025

- 2025/2026 School Year fund II – November 2025

- Elementary School Fund – December 2025

- Wear & Tear – No, as it stands we’ll only add to it one time in December.

A reminder of the pie in the sky money goals.

- Elementary School Fund II

- Middle School Fund

- High School Fund

- Big Anniversary

- Wear & Tear

- Emergency Fund

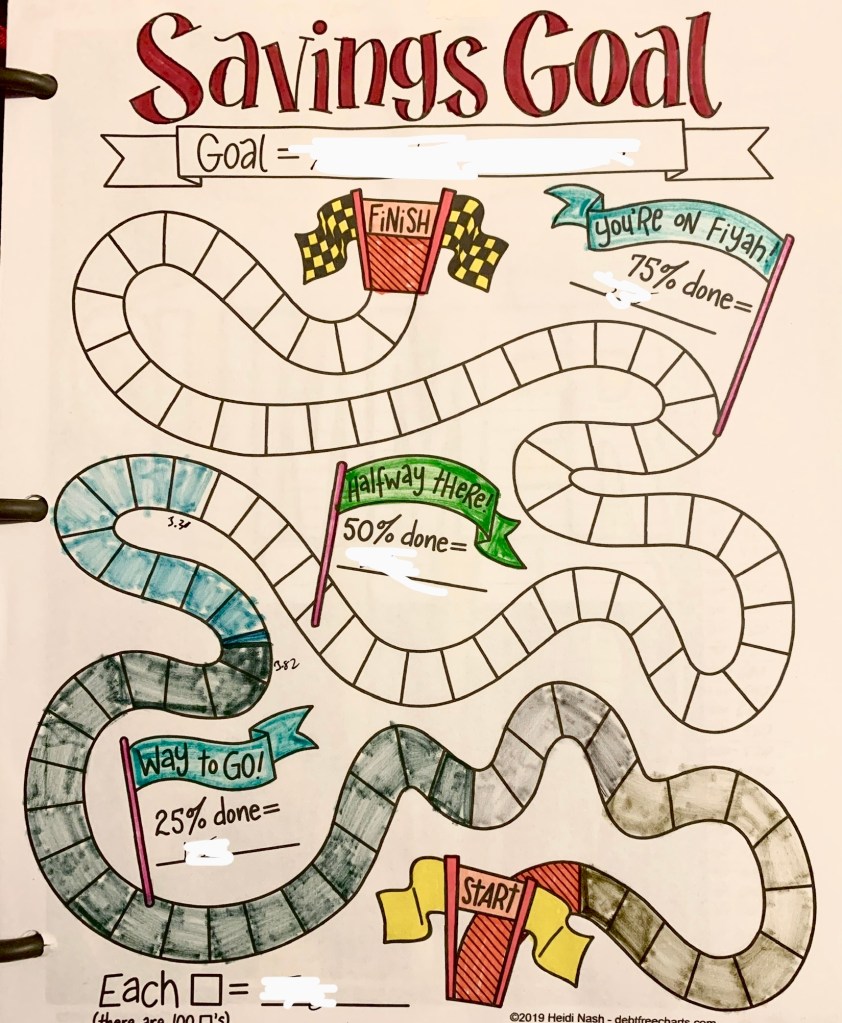

I use charts from DebtFreeCharts.com They follow Dave Ramsey and have a variety of charts that you can use to track your progress. They offer a lot of free charts as well as inexpensive individual and bundle charts. They have three main styles, the one I use most is the 529 image. Text ones where each letter is broken into sections. And image ones, typically in the form of a game, what I’m using for the taxes and fees for the new phones. .

P.S. If this was useful my one-page Sinking Funds Tracker is in the shop, or you can tip on Ko-fi or PayPal. One tiny move is progress.

This post reflects my personal experience and opinions. I share our real-life money – rounded numbers, personal choices, (tiny) next steps. It is not financial advice. I’m not a financial advisor. Budgeting and money topics are shared for education and entertainment only. Your situation is unique; verify details before acting. Small steps count.

Personal experiences only—this isn’t professional advice. See Disclosures and Terms.

Leave a comment