Net worth is a two way street.

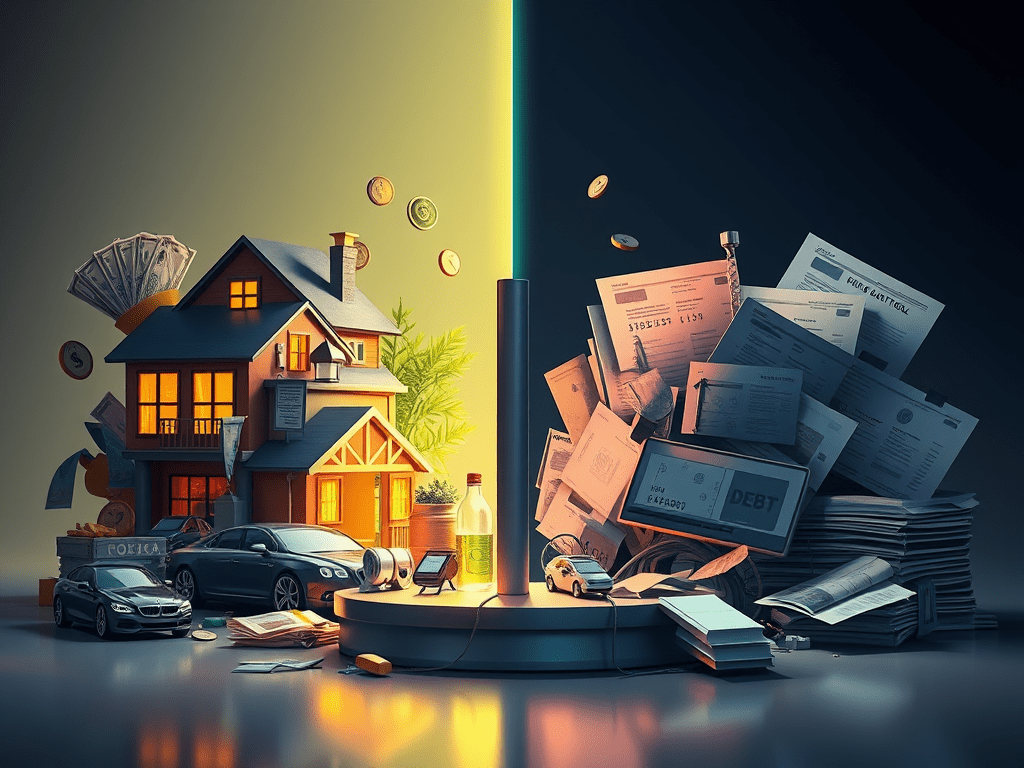

Assets increase your net worth. How much you have in your bank accounts. Your cash on hand. The value of your property; cars, your primary residence, any other real estate. The value of your investment accounts; HSA, 401(k), IRA, any investment accounts. Every penny to your name increases your net worth.

Liabilities decrease your net worth. Your debts. Anything you owe, to anyone or anything. Your net worth doesn’t care what if debt is ‘good’ or bad’ so count it all. Student loans; private, subsidized, unsubsidized, etc. All of your credit cards, including store cards. What you owe on your property. Any personal loans. Every penny you owe decreases your net worth.

This means two things. Bad news first; you can have a negative net worth. Good news, that means you have two ways to increase your net worth.

Which means you have three routes to improve your net worth.

- Decrease your liabilities.

- Increase your assets.

- Simultaneously decrease liabilities and increase assets.

Where you are in your financial journey will help you decide which route is best for you. We chose to focus on decreasing our liabilities. I do regret that we didn’t put at least token amounts in an IRA. We could have started earning some compound interest while paying off debts.

P.S. If this was useful my one-page Sinking Funds Tracker is in the shop, or you can tip on Ko-fi or PayPal. One tiny move is progress.

This post reflects my personal experience and opinions. I share our real-life money – rounded numbers, personal choices, (tiny) next steps. It is not financial advice. I’m not a financial advisor. Budgeting and money topics are shared for education and entertainment only. Your situation is unique; verify details before acting. Small steps count.

Personal experiences only—this isn’t professional advice. See Disclosures and Terms.

Leave a comment