-

Continue reading →: Preparing for Career Changes: The Grind and The Hustle

Continue reading →: Preparing for Career Changes: The Grind and The HustleThe author reflects on preparing for potential employment changes while juggling feelings of anxiety and productivity. They detail a dual strategy involving resume enhancement and income diversification, focusing on passive income through an Etsy shop. The piece underscores the importance of personal improvement and proactive planning in uncertain times.

-

Continue reading →: How We Manage Our Family’s Allowance System

Continue reading →: How We Manage Our Family’s Allowance SystemThe author describes their family allowance system, where both adults and their child, Riley, receive a monthly allowance. Riley, starting at age three, earns a dollar per year of age without chores, emphasizing family membership. The allowance is divided into categories: Spend, Save, Share, and Store, promoting financial concepts while…

-

Continue reading →: Preparing for Job Change: My Career Timeline with ChatGPT

Continue reading →: Preparing for Job Change: My Career Timeline with ChatGPTFollowing a leadership shake-up at my company, I’ve intensified my career preparation using ChatGPT. This includes enhancing my resume, pursuing certifications, and monetizing my blog. I seek to create income streams outside my job while budgeting for family adventures. I aim to remain proactive amid uncertainty regarding my employment’s future.

-

Continue reading →: Embracing the Journey: Fun Adventures on the Road

Continue reading →: Embracing the Journey: Fun Adventures on the RoadThe author’s weekend journey to an North Carolina beach, highlights the importance of enjoying the journey rather than just the destination. Encountering the a Volunteer Fire Department provided an unexpected, delightful break, while taking a ferry turned out to be a memorable adventure, reinforcing the joy of spontaneity in travel.

-

Continue reading →: Exploring Personal Finance

Continue reading →: Exploring Personal FinanceThe author expresses a passion for personal finance and briefly considered becoming a Personal Finance Coach. Although knowledgeable, they hesitate to advise others strictly. They explore the idea of becoming a financial conservator but fear the responsibility of managing someone else’s finances due to past mistakes and potential accusations of…

-

Continue reading →: Planning for Financial Stability Amid Job Layoffs

Continue reading →: Planning for Financial Stability Amid Job LayoffsLast week, the author’s workplace faced massive layoffs, starting with part-time employees and continuing with full-timers. Amidst uncertainty, they considered job security and financial planning. Emphasizing the importance of maintaining emergency funds and other savings goals, they decided to stay at their job while reassessing financial needs and goals.

-

Continue reading →: Mastering Zero Based Budgeting for Financial Success

Continue reading →: Mastering Zero Based Budgeting for Financial SuccessZero-based budgeting emphasizes planning every dollar of income, ensuring that all funds are allocated, even small amounts. It utilizes methods to manage fluctuating bills and income effectively. Updating the budget with new information and having a plan for additional funds are crucial for financial success. Clarity and specificity in allocations…

-

Continue reading →: How to Handle Extra Money at Month-End Effectively

Continue reading →: How to Handle Extra Money at Month-End EffectivelyThe post discusses managing leftover money and interest from savings. It emphasizes the importance of consistent budgeting, pooling extra funds, and reallocating them towards financial goals. It suggests keeping a plan for at least six months to see progress and highlights the cumulative benefits of interest over time from High…

-

Continue reading →: Budgeting Tips for Better Financial Freedom

Continue reading →: Budgeting Tips for Better Financial FreedomA budget is often viewed negatively as a constraint, restricting enjoyment of life. However, it can be perceived as a travel plan guiding financial goals. Instead of feeling limited, individuals should adjust budgets flexibly, prioritize needs over wants, and treat budgeting like planning for a road trip, allowing for unexpected…

-

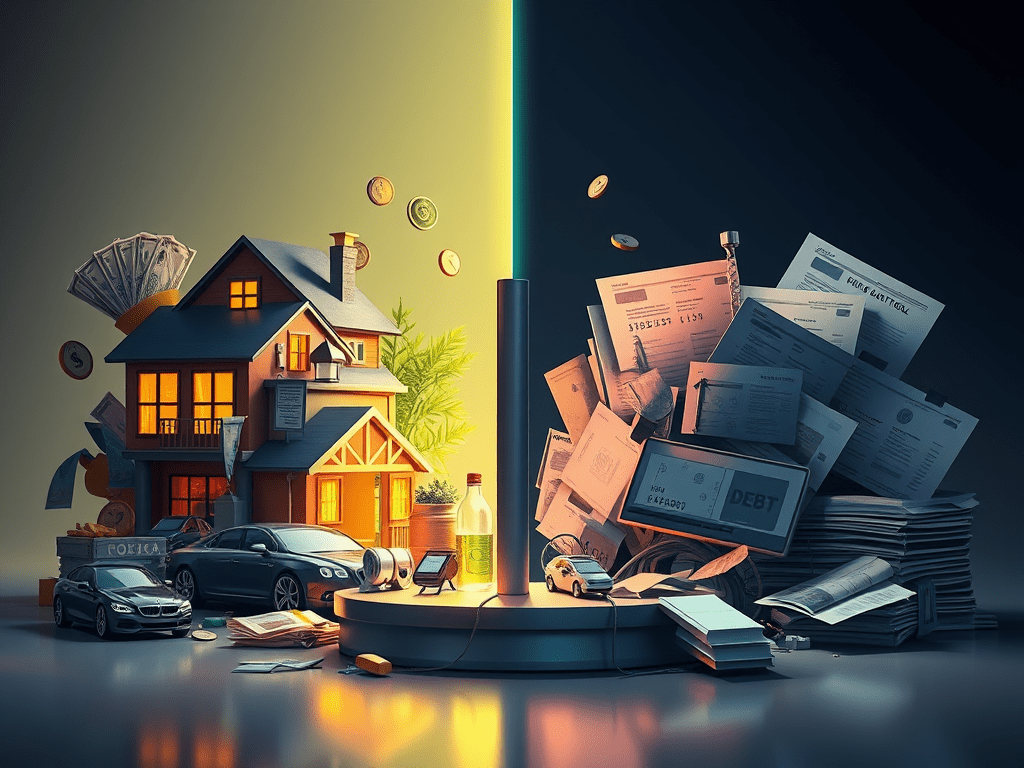

Continue reading →: Understanding Net Worth: Assets Vs. Liabilities

Continue reading →: Understanding Net Worth: Assets Vs. LiabilitiesNet worth is determined by assets, which increase it, and liabilities, which decrease it. One can have a negative net worth. To improve it, one can decrease liabilities, increase assets, or do both simultaneously. The author chose to focus on decreasing liabilities but regrets not investing in an IRA earlier.

Real-life money: budgets, small steps, and gentle systems.

Welcome to Lacking A Nail

I’m crafting life from the middle of the story. Make money manageable – budgets, sinking funds, simple systems. Slowly moving from a money focused life ruled by a scarcity mindset to a creative self-discovery, small adventures, and experiencing life on a mindful budget.

This is a blog/public Journal. I post my opinion. I am not an expert. Everything posted is for entertainment purposes.